Bajaj Finserv Nifty 1D Rate Liquid ETF is an open-ended Exchange Traded Fund (ETF) launched by Bajaj Finserv Mutual Fund on May 13, 2024. It aims to provide current income with low risk and high liquidity by investing in tri-party repo on government securities, T-bills, and repo/reverse repo. The ETF tracks the Nifty 1D Rate Index, aiming to deliver similar returns (before expenses) with minimal tracking error. The New Fund Offer (NFO) is open for subscription until May 16, 2024, with a minimum investment of Rs 5,000 and no entry load.

The investment objective of Bajaj Finserv Nifty 1D Rate Liquid ETF is to seek to provide current income, commensurate with low risk while providing a high level of liquidity through a portfolio of Tri-Party Repo on Government Securities or T-bills / Repo & Reverse Repo. The Scheme will provide returns that before expenses, closely correspond to the returns of the Nifty 1D Rate index, subject to tracking error. However, there can be no assurance or guarantee that the investment objective of the Scheme will be achieved

This NFO of Bajaj Finserv Nifty 1D Rate Liquid ETF is suitable for investors who are seeking short-term savings solutions and to gain some returns by investing in securities covered by the Nifty 1D Rate Index with low risk and a high level of liquidity

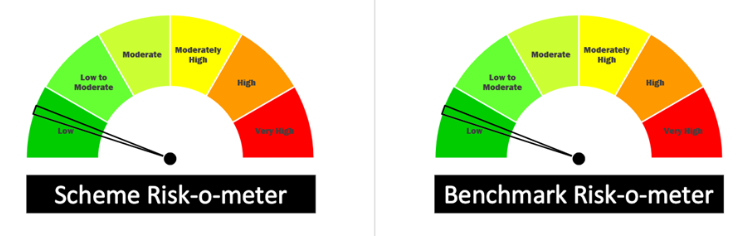

Potential Risk Class: it’s an open-ended scheme, with relativelylow interest rate risk and relatively low credit risk (A – I).

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Tri-Party Repos in Government

Securities or Treasury Bills (TREPS) |

Low | 95 | 100 |

| Units of Overnight/ Liquid schemes#,

Money Market Instruments (with maturity not exceeding 91 days), cash & cash equivalents. |

Low to Moderate | 0 | 5 |

The performance of the Bajaj Finserv Nifty 1D Rate Liquid ETF is benchmarked against the Bajaj Finserv Nifty 1D Rate Liquid ETF.

The fund is managed by Mr. Siddharth Chaudhary, a Senior Fund Manager – Fixed Income with Bajaj Finserv Mutual Fund since July 2022. He brings 18 years of experience in the financial sector, having previously held positions at Sundaram Asset Management Co. Ltd as Head Fixed Income – Institutional Business, Senior Fund Manager – Fixed Income, and Fund Manager – Fixed Income.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 13-05-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| Nippon India ETF Nifty 1D Rate Liquid BeES DAILY | 08-07-2003 | 11230.62 | 0.69 | 2.06 | 6.16 | 3.94 | 2.99 | 2.86 |

| HDFC Nifty 1D Rate Liquid ETF | 01-08-2023 | 44.74 | 0.5 | 2.42 | – | – | – | – |

| DSP NIFTY 1D Rate Liquid ETF IDCW Daily Reinvest | 08-03-2018 | 1154.75 | 0.4 | 2.47 | 6.94 | 4.28 | 3.21 | 3.42 |

| Kotak Nifty 1D Rate Liquid ETF | 24-01-2023 | 47.11 | 0.2 | 2.55 | – | – | – | – |

| ICICI Prudential S&P BSE Liquid Rate ETF | 05-09-2018 | 3259.53 | 0.25 | 2.56 | 7.12 | 4.64 | 3.26 | 3.11 |

| Mirae Asset Nifty 1D Rate Liquid ETF | 27-07-2023 | 381.51 | 0.27 | 2.67 | – | – | – | – |

| ETFs | – | – | – | 4.19 | 24.46 | 3.44 | 21.68 | 13.63 |

Data as of May 13, 2024

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Start Your Mutual Fund Investments Journey Today

Join our 2 Cr+ happy customers

Enjoy Zero Brokerage on

Equity Delivery